LuxHedge is pleased to invite you to the next Alternative UCITS seminar in Zurich

“Choosing the right strategy and the right manager has become more important than ever”

Tuesday, November 12, 2019

9am – 2pm (lunch included)

Widder Hotel

Rennweg 7, Zurich

Seminar organised in collaboration with

Speakers

Tim Vanvaerenbergh

CEO

LuxHedge

Thomas Einzmann

Senior Portfolio Manager

Greiff Capital Management AG

Antoine Haddad

CEO and Managing Partner

Bainbridge Partners LLP

Laurent Kenigswald

Chief Investment Officer

Butler Investment Managers

Jan-Peter Sissener

Partner, Managing Director and Portfolio Manager

Sissener

“Diversification is the only free lunch in Finance.”

– Harry Markowitz

Under the current challenging market conditions, many investors are rethinking their portfolios and considering to increase allocations to alternatives. 2018 proved to be a difficult year for many Aternative UCITS funds, picking the right manager and strategy has become more important than ever.

Historically restricted to a small privileged audience, a broad range of Alternative strategies is now widely available in a regulated, liquid UCITS form. LuxHedge is the specialist data provider and knowledge center in this fast growing market. On this event for professional investors, 3 alternative fund managers will present their story, their approach to generate added value and their investment strategies that deliver absolute returns.

Schedule

09:00 – 09:30

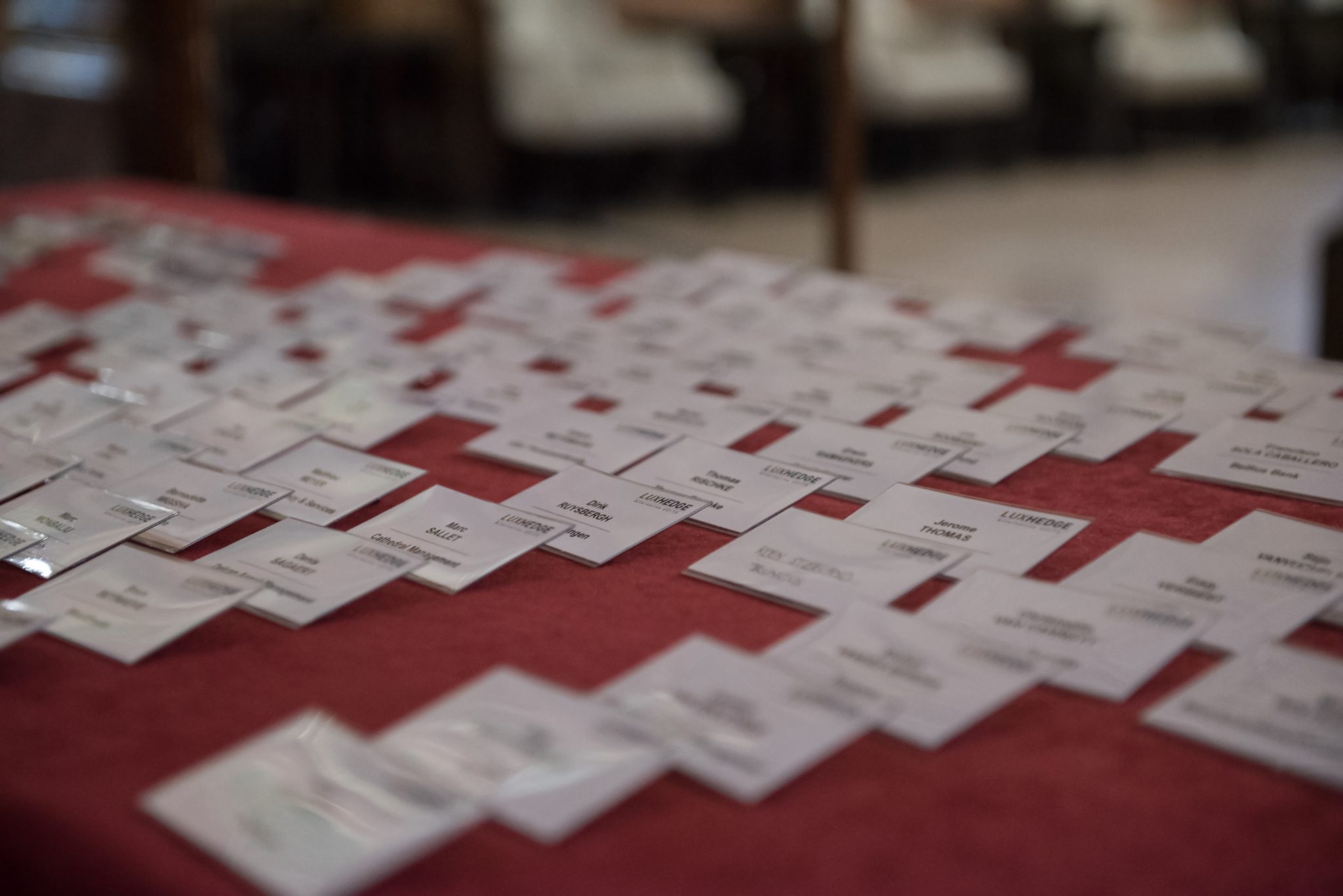

Welcome & Registrations

09:30 – 09:50

Alternative UCITS: Market overview, trends, fund selection & portfolio construction

Tim Vanvaerenbergh, CEO LuxHedge

10:00 – 13:00

In depth on Alternative Strategies

Event Driven – Greiff Capital Management AG

Thomas Einzmann

Senior Portfolio Manager

Equity Long/Short Global – Sissener

Jan-Peter Sissener

Partner, Managing Director and Portfolio Manager

Absolute Return Credit – Butler Investment Managers

Laurent Kenigswald

Chief Investment Officer

Equity Market Neutral – Bainbridge Partners LLP

Antoine Haddad

CEO and Managing Partner

13:00 – 14:00

Lunch

Managers and Strategies

Founded by Jan-Petter Sissener in 2009, Sissener AS is an investment firm with considerable knowledge and a very solid track-record. The creation of the company was anchored in a strong desire to create asset management products where the manager receives a success fee only after having created a reasonable return for investors. At the end of 2018, Sissener managed more than 3 Billion NOK for private and institutional investors.

Sissener Canopus is a fund created for investors who aim to make money, rather than cover market exposure like many of the more traditionally oriented long/short equity funds. The fund has a global mandate and has 100% flexibility to invest in those industries and regions in the world that the fund management team deems as being most attractive. “We go long what we like and we short what we don’t like” is one of the credo’s of founder Jan-Petter Sissener. Well-known in its home market of Norway and awarded numerous times by international hedge fund media as the best long/short equity fund of the past 7 years, the fund is still relatively unfamiliar to investors outside of Nordics.

Butler Investment Managers has been specializing in European High Yield strategies since the firm’s launch in 2008. Current AUM stand close to €800 m across long/short, long-only and short duration funds. The company focuses on absolute return strategies with an emphasis on preservation of capital, low volatility and a persistent ability to generate alpha in all market conditions. Based in Paris, the portfolio management team has worked together under the leadership of Laurent Kenigswald for over 14 years. With its impeccable track record, Butler Investment Managers has established itself as one of the leading and most recognized manager in the European High Yield space. The company is part of Butler Corum, a pan-European asset manager with €3.5 billion in liquid credit strategies and real estate funds. The group has offices in 8 countries.

Butler European High Yield Fund is one out of three UCITS funds under Butler IM’s management. The fund has a flexible, opportunistic mandate and a proprietary three pronged approach to position exposure according to perceived market and credit risk. The strategy is designed to be actively managed and is more flexible than traditional long only funds, allowing to offer some downside protection in falling markets.

Greiff Capital Management AG is a German investment management company located in Freiburg, Baden-Württemberg. Since its establishment in 2005, Greiff has grown into a specialized boutique delivering unique investment solutions. The core focus and strengths of the investment team are intelligent derivative, equity event driven and systematic equity strategies. Within the last two years, Greiff has been growing fast and overseas more than €1bn in AUM and moving forward we are keen to build on this success whilst continuing to provide quality services to our clients.

The portfolio of GREIFF “special situations” Fund consists of four components: SAFETY (domination and profit and loss transfer agreements, squeeze-outs), EVENT (e.g. merger arbitrage), SPECIAL SITUATIONS (equities in special situations) and HIDDEN ASSETS (unreported rights to subsequent compensation). Within this framework, the fund invests primarily in companies in German-speaking countries with attractive acquisition, restructuring and/or squeeze-out potential. Equities are selected using an internal and independently developed valuation system. The weighting of the individual components within the portfolio varies over time and depends on the condition of the M&A market. The portfolio also benefits from unreported hidden reserves arising from rights to subsequent compensation from ongoing litigation in connection with squeeze-outs and domination and profit and loss transfer agreements. The fund strives to generate returns independent of market performance while at the same time minimizing risk.

Bainbridge Partners is an alternative investments specialist firm founded by Antoine Haddad in 2002 and managing close to $800 MM in liquid absolute return strategies, across a range of quantitative strategies. The firm manages assets for institutions, family offices, and private banks globally in commingled vehicles or dedicated managed accounts. The firm has recently launched a UCITS fund for “Bainbridge Equity Market Neutral” strategy. The fund is part of Lux-Multimanager SICAV, an umbrella structure run by BIL Manage Invest, a subsidiary of Luxembourg’s third largest bank – Banque Internationale a Luxembourg (BIL).

Bainbridge Equity Market Neutral’s strategy relies on more than 12 short and medium-term, uncorrelated systematic alpha strategies applied to more than 4000 stocks across three continents. The strategy aims to have an equal risk exposure to all its models, while targeting a stable long-term volatility of 6% to 8% and maintaining an overall neutrality to equity markets over the medium term. The fund has achieved a top-quartile performance since its inception, relative to its largest, well known quantitative, equity market neutral peers. Bainbridge’s team focuses its ongoing research efforts on finding additional alpha sources, while avoiding exposures that add negative skew to the overall strategy.