LuxHedge is pleased to invite you to the next Alternative UCITS seminar in Geneva

“Alternative UCITS, an asset class on its own”

Tuesday, March 27, 2018

9am – 2pm (lunch included)

Four Seasons Hotel des Bergues

Quai des Bergues 33, Geneva

Seminar organised in collaboration with

Speakers

Tim Vanvaerenbergh

CEO

LuxHedge

Vincent Weber

Portfolio Manager & Head of Research

Prime Capital

Lucio Soso

Lead Portfolio Manager

Bellevue Asset Management

Duncan Moir

Sr. Investment Manager

Aberdeen Standard Investments

Alex Burt

Associate Product Manager

Schroders GAIA

Ali Towfighi

Managing Director

Wellington

“Diversification is the only free lunch in Finance.”

– Harry Markowitz

All investors realize the need to diversify and build robust portfolios that withstand the sell-offs to come, using products that are regulated and liquid. This is precisely what Alternative UCITS funds have to offer. They are designed as portfolio “shock absorbers” during periods of stress and focus on genuine diversification by delivering absolute returns, de-correlated from equity and fixed income markets. Historically restricted to a small privileged audience, a broad range of Alternative strategies is now widely available in a regulated, liquid UCITS form. LuxHedge is the specialist data provider and knowledge center in this fast growing market. On this event for professional investors, 4 alternative fund managers will present their story, their approach to generate added value and their investment strategies that deliver absolute returns.

Schedule

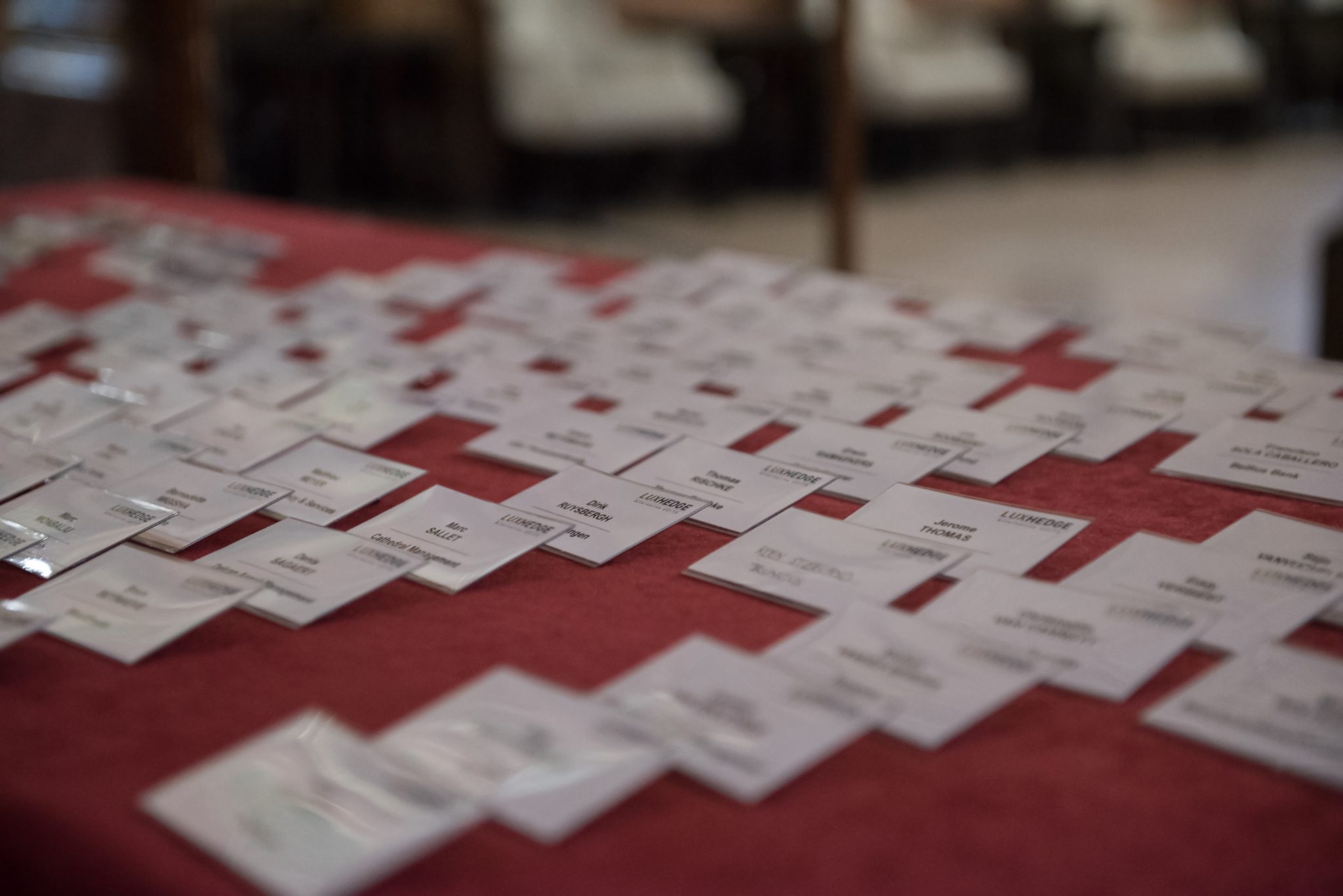

09:00 – 09:30

Welcome & Registrations

09:30 – 09:50

Alternative UCITS: Market overview, trends, fund selection & portfolio construction

Tim Vanvaerenbergh, CEO LuxHedge

10:00 – 12:55

In depth on Alternative Strategies

Systematic Macro – Prime Capital

Vincent Weber

Portfolio Manager & Head of Research

Global Macro – Bellevue Asset Management

Lucio Soso

Lead Portfolio Manager

Alternative Risk Premia – Aberdeen Standard Investments

Duncan Moir

Sr. Investment Manager

Hedge Fund Multi Strategy – Wellington

Ali Towfighi

Managing Director

13:00 – 14:00

Lunch

Managers and Strategies

Prime Capital was founded in 2006 as a specialist manager that focuses on alternative investments. We cover the whole liquidity spectrum: liquid investments like our Target Beta fund, hedge funds with monthly or quarterly liquidity, private debt and infrastructure. These different businesses are managed by different investment teams that focus on their area of expertise. All these make use of the common compliance and IT resources of Prime Capital. Our firm has grown a lot over the past 10 years and we currently manage 10BEUR in assets.

Target Beta Fund

The Target Beta Fund is a systematic macro fund investing across asset classes and regions. The investment strategy is based on the positive attributes of established asset allocation approaches, such as risk parity, tactical asset allocation and risk premia investing. The portfolio is managed to deliver an annualized return of cash + 5% with an average volatility of 6% p.a.

Bellevue Group is an independent Swiss financial boutique listed on the SIX Swiss Exchange. Established in 1993, the company and its approximately 100 professionals are largely active in the areas of asset management and wealth management. The Asset Management segment offers a select range of active equity strategies in fast-growing markets, the healthcare sector and in other special themes such as owner-managed companies, as well as successful holistic investment strategies across all traditional asset classes.

BB Global Macro fund

Absolute return strategies within a UCITS fund vehicle are a viable alternative for investors with conservative investment styles and profiles. The BB Global Macro (Lux) Fund has consistently achieved attractive returns across very divergent market environments. Its approach to asset management makes positive returns a reality, regardless of the general sentiment and environment on financial markets.

The Fund’s objective is to generate consistent absolute returns of 5-7% per annum with a Sharpe ratio of one in any market environment. The Fund invests globally in government bonds, equity indices, currencies and other asset classes with the possibility to build up long and short exposure. The portfolio is mainly invested in very liquid assets and the Fund offers daily liquidity.

Standard Life Aberdeen plc is one of the world’s largest investment companies, created in 2017 from the merger of Standard Life plc and Aberdeen Asset Management PLC. Operating under the brand Aberdeen Standard Investments, the investment arm manages $764.3bn of assets, making it the largest active manager in the UK and the second largest in Europe. It has a significant global presence and the scale and expertise to help clients meet their investment goals. As a leading global asset manager, Aberdeen Standard Investments is dedicated to creating long-term value for our clients. The investment needs of our clients are at the heart of what we do. We offer a comprehensive range of investment solutions, as well as the very highest level of service and support.

Aberdeen Alternative Risk Premia Fund

The Fund is a multi-strategy, multi-asset risk premia focused UCITS fund. Investing across equities, bonds, interest rates, currencies, commodities and credit, the Fund is a broadly diversified blend of systematically captured risk premia, including value, carry, momentum, and several equity style strategies, including low beta, market cap, value and quality. Given the high valuations across traditional equities and bonds, alternative risk premia provide a compelling source of long-term returns with a very differentiated return profile.

Schroders is a global asset manager helping institutions, intermediaries and individuals meet their investment goals and prepare for their financial future. Schroders is responsible for €503bn (31/12/2017) of assets for their clients who trust them to deliver sustainable returns and create long-term value. Today, Schroders employs over 4,600 people (Dec 2017) across six continents that focus on doing just this.

Schroder GAIA Wellington Pagosa Fund

Schroder GAIA Wellington Pagosa is a multi-strategy, multi-manager fund that invests across long/short equity, absolute return fixed income, and market neutral. The fund seeks to generate consistent, positive returns across market cycles while managing market risk exposure and minimising drawdowns. It is based on Wellington’s existing ‘Pagosa’ strategy, which has been managed by Christopher Kirk and Dennis Kim since its inception in January 2012.