09 May 2018 Philippe Sarreau Fund Manager PTR-Corto Europe Pictet Total Return Equities

Philippe Sarreau is the fund manager of PTR-Corto Europe. He has been working at Pictet Asset Management since 1998 and has more than 27 years of investment experience.

LH: Can you briefly introduce Pictet Asset Management and its Total Return activity to us?

Pictet: Pictet Asset Management is the institutional asset management arm of the Pictet Group, managing 164BEUR of the entire Pictet Group’s 435BEUR. The Total Return part represents 10BUSD which makes Pictet Asset Management one of the largest Hedge Fund managers in Europe. Our Total Return investment teams are based in five locations: Geneva, London, Singapore, Tokyo and Hong Kong. We’re managing 12 different strategies including equity long/short directional, equity market neutral, credit long/short, and a large multi strategy fund.

LH: What is the history of the PTR-Corto Europe fund?

Pictet: The strategy was originally launched in 2005 and became a Cayman fund in 2006. It was one of the first equity long/short funds launched by Pictet at the time. The strategy was very successful and popular with clients and we decided to also offer it in a UCITS fund in 2010 which marks the birth of the “PTR-Corto Europe”.

LH: Can you give an overview of investors in the strategy? What type of clients are especially interested in long/short equity return streams?

Pictet: Our customer base is very wide, going from retail clients to institutional investors like pension funds and insurance companies. Besides the UCITS fund which currently stands at 350MEUR, the strategy is available in a managed account form and it’s also one of the strategies in our multi strategy flagship PTR- Diversified Alpha. Across the different product forms, there’s about 1BEUR invested in the Corto strategy by clients that are globally divided between Europe, Japan and USA.

LH: What are the main characteristics of the PTR Corto fund?

Pictet: PTR Corto is a directional long/short equity strategy where we aim to outperform European Equities over the cycle with less volatility through alpha generation in both the long and short side of the book. Our net long exposure is between 20% and 60% on average with a gross exposure that varies between 120% and 180%. Although we invest mainly in single names, both long and short, we also use derivatives like options and swaps to take tactical exposures or hedge against unwanted market risks.

LH: How many positions would the fund typically hold?

Pictet: Our portfolio consists of about 60 to 70 long positions and 50 to 60 short positions. The weight of each long position varies between 1% and 5%, between 1% and 3% for shorts. Position sizes are determined on a case by case basis where we look at the strength of our conviction, expected volatility and liquidity of the security. Ultimately this results in a diversified portfolio of approximately 120 long and short positions that are spread across many regions, sectors and different market capitalisations.

LH: What kind of volatility, return and market beta do you expect for PTR Corto?

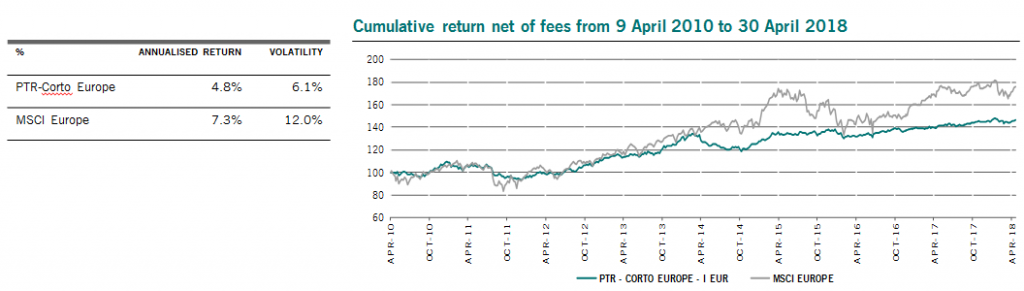

Pictet: This fund can serve as a substitute for some or all of the equity allocation of a long only portfolio with the potential of improving the overall risk/return trade-off. Our annual volatility since launch is 6.1% for an annual net return of 4.8%, compared to an average volatility of 12% and annualized return of 7.3% for the MSCI Europe Index. Against a risk/return ratio of about 0. 6 for the index, PTR Corto did considerably better with a risk/return ratio of 0.8.

Our market beta is dynamic and has been 0.24 on average (ex post beta) since the launch of the UCITS fund in 2010. This clearly shows that the main source of performance has been alpha, generated both on our long and short positions.

LH: Can you introduce the team that manages PTR Corto on a day-to-day basis?

Pictet: We have a very experienced French-Italian team of 4 people which together represent over 80 years of investment experience. We consider ourselves to be a “multicap” team with backgrounds ranging from small cap to big cap stocks, certainly one of the keys to successful investing in equities.

We also benefit from the experience and investment ideas of several thematic equity teams at Pictet who are each specialists in a specific sector. We have a team that invests exclusively in luxury goods companies and has thus developed a unique perspective on both listed and unlisted companies in the luxury sector. This is a significant advantage to Pictet and of course we make use of this expertise in our long/short fund as well. Similarly, there are dedicated teams engaged in robotics, digital development, renewable energy, security, and so on. This large group of people who are true experts in their sector help us to pinpoint structural trends that look promising and have been underappreciated by the market.

LH: What is your investment philosophy and how does this translate into the investment process for this fund?

Pictet: We meet a lot of businesses and adopt the approach of Peter Lynch (manager of the legendary Magellan Fund at Fidelity) who advocated that a manager should focus his eyes on the outside world. We do not confine ourselves to our Bloomberg screens all the time. The European equity universe that we consider consists of about 5,000 companies where we make a first selection based on our fundamental research platform. Ultimately, we are real bottom-up stock pickers.

As a first step, we identify structural changes at different levels and judge whether certain businesses will either benefit or suffer from these changes. In other words, we’re looking for positive or negative drivers for businesses and sectors. These may be significant changes within a company itself, such as the appointment of a new management team or a new CEO, but also major industry shifts coming from regulatory or price level changes. Recent examples include what’s happened in the European electricity market, higher commodity prices, higher wages in China, or the fact that Europe is clearly lagging behind the US in the area of digitalisation.

Secondly, we will look at how a company will use these elements to either create or destroy value by looking at two very simple metrics. First, we focus on Return On Capital Employed (ROCE) to judge whether management is maximizing operations of the firm. Do the executives maximize margins, do they generate sufficient cash flow, are they optimally making use of working capital and the balance sheet? Secondly, we will discuss with management how exactly they will allocate their capital to maximize profit growth. Is the cash that is generated by the business reinvested in existing operations? Will they geographically expand or invest in other activities? Are they buying a competitor or will cash be distributed to existing shareholders?

All these elements will determine the valuation of a company and this 2 step exercise ultimately results in our long and short positions.

LH: Can you give an example of such a structural trend that has translated into an actual investment idea?

Pictet: Digitalization is a strong structural trend. However, when you look at the European digital market, there are about 10 companies which are essentially overpriced listed online retailers such as Zalando, plus a few companies that deliver food at home. Given the high valuations for these companies, we did not find them attractive.

Instead, we thought about similarities and common ground within this tech segment and figured that all these products had to be transported to the consumer. For several years, the market of carton boxes has grown between 5% and 9% annually, where there used to be hardly any growth. We therefore decided to invest in packaging companies such as Stora Enso and Smurfit Kappa. We also looked at machine builders for cardboard, an approach that has certainly paid off.

The challenge is always to identify major underlying structural trends and then find the right way to play them. These are not always obvious to find. In this case, instead of buying overvalued companies, we bought companies with huge profit potential who at the time were valued at only 6 to 7 times EBITDA.

LH: Can you give an example of a successful trade on the long side?

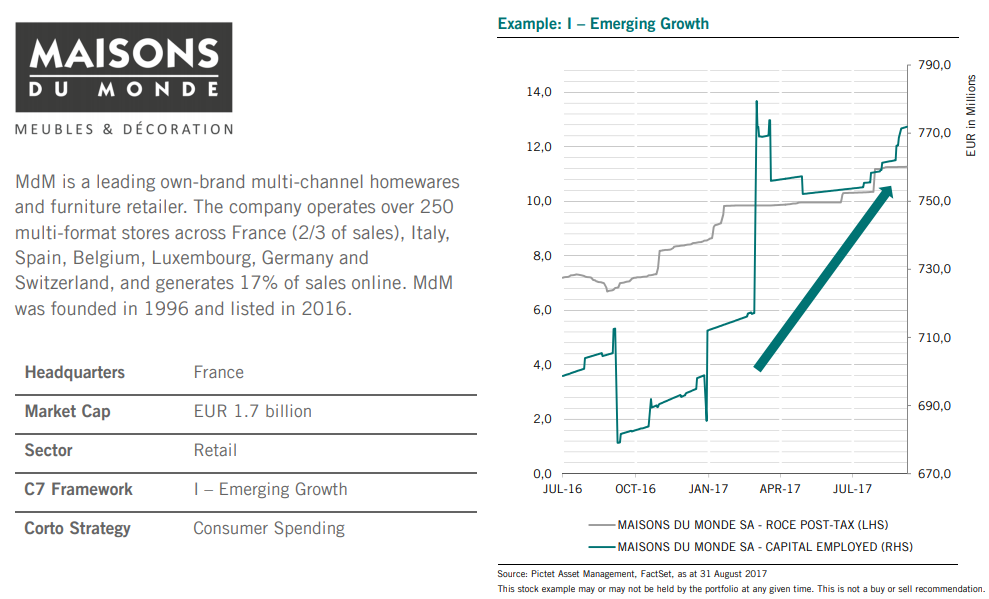

Pictet: Last year, we very much liked Maisons du Monde, a store that specializes in decoration and furniture. This company managed to grow its business by opening new stores without weighing on their margins. Each new store was profitable very quickly, provided a positive return on investment and was able to contribute rapidly to the bottom line. Meanwhile, digital sales, which accounted for 25% of the company’s business, had managed to grow strong with attractive margins and not too much capital invested. Ultimately Maisons du Monde managed to increase its balance sheet, while simultaneously increasing the return on capital. This led to a re-rating of the shares, which doubled within 18 months.

LH: How do you decide to take on a short position in a company?

Pictet: On the short side, we are interested in companies who consistently re-invest cash into existing operations without sufficiently realizing that these are saturated and that the surrounding dynamics have completely changed. As a consequence, their ROCE (Return On Capital Employed) is in structural decline.

A typical example is Hennes & Mauritz, which we do not hold in the portfolio, but which is structurally underperforming the market since 5 years for exactly this reason. Their decrease in return on capital started in the period 2008-2009 when Chinese labour costs began to rise. Combined with falling sales prices, H&M percentage margins got squeezed. They did succeed to keep total margins growing by using a lot of capital which initially set a lot of market analysts on the wrong foot. But that situation did not last forever and the market eventually recognized the structural problems their business faced.

In addition to increased use of capital in lower-return investments, these companies also often start acquiring other companies. A prime example of this would be Sanofi whose share price got really hit because the market realized this.

Another short idea can come from looking at companies that bend accounting rules to the maximum like Banco Popular where we held a short position from 2007 all the way to 2014.

LH: How hard is it to find good short opportunities when the market is in a strong upward trend like in recent years?

Pictet: It is true that many Long/Short portfolios were forced in recent years to have a strong long focus. The massive intervention by central banks combined with a more difficult regulatory environment for taking on short exposures were the main reasons for this. Also, taking on a short exposure is always asymmetric because the available information is skewed towards positive stories. Companies like to announce when they win a contract, but on the other side remain very silent when they lose a big client. Finally, the past few years were characterized by a “buy the dip” mentality where any small correction was immediately seen as a great buying opportunity.

I believe that today the cards are completely different. Central bankers are leaving the stage and regulators get less in the way of short speculators because the large banks are saved and the system is stable again. It’s already clear that volatility has returned to the equity markets and the recent decline in February has been a clear wake-up call for a lot of investors.

LH: Do you feel today is a particularly good moment to invest in long/short equity strategies?

Pictet: Yes, there’s clearly more benefit in long/short propositions today with more opportunities to generate alpha on the long and the short side of the book again. We are beyond the point where you could just throw money randomly at the market and get a good result. The coming times will be harder and difficult work will have to be done by active managers to find value in the market. Good long/short managers will undoubtedly benefit from this environment where risk / reward ratios are normalizing again.

LH: Is there any current trend that you strongly believe in?

Pictet: The ongoing digitalization of our global economy is very beneficial for strong brand names. Nowadays, a great brand has a direct access to the end consumer, roles of middlemen and intermediaries are increasingly being cut out of the supply chain. This is one of the reasons why Adidas is currently showing such a strong performance and why we really like the name. We currently feel that market participants have not yet fully realized what this change means and how big of an advantage strong brands really have.

In some sectors, this direct access to consumers is working against the current big names. Beer is a prime example. With high beer prices and social media helping to build brands more quickly, the door has opened for a large number of small specialty brewers. It should not come as a big surprise that ABInBev is facing problems because their model is under severe pressure.

LH: Many thanks for the interview !

Disclaimer

LuxHedge SA/NV is a limited liability company governed by the laws of the grand duchy of Luxembourg. This report is for Institutional Investors only and is not suitable for Retail Investors. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but we make no representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of such information. In addition we have no obligation to update, modify or amend this document or to otherwise notify a recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate or other market or economic measure. Furthermore, past performance is not necessarily indicative of future results. The recommendations mentioned herein involve numerous risks including, among others, market, counterparty default and illiquidity risk. An investor could lose its entire investment. This communication is provided for information purposes only. In addition, any subsequent offering will be at your request and will be subject to negotiation between us. It is not intended that any public offer will be made by us at any time, in respect of any potential transaction discussed herein. Any transaction that may be related to the subject matter of this communication will be made pursuant to separate and distinct documentation and in such case the information contained herein will be superseded in its entirety by such documentation in final form. By retaining this document, recipients acknowledge that they have read, understood and accepted the terms of this notice. Each recipient of this document agrees that all of the information contained herein is confidential, that the recipient will treat information confidentially, and that the recipient will not directly or indirectly duplicate or disclose this information without the prior written consent of LuxHedge. Recipients who do not wish to undertake a further investigation of the contents of this presentation agree to return this document promptly to the LuxHedge. This notice shall be governed by and construed in accordance with Luxembourg Law. This document and the information contained therein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. Any direct or indirect distribution of this document into the United States, Canada or Japan, or to U.S. persons or U.S. residents, is prohibited.