11 Dec 2018 Alternative UCITS funds continue to edge lower

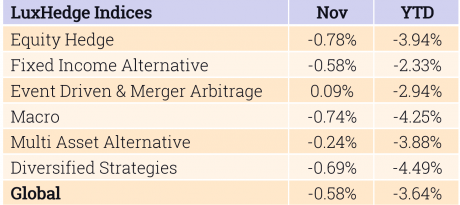

The average Alternative UCITS fund continues to have a difficult time performing in 2018. The LuxHedge Global Alternative UCITS Index posted a loss of -0.59% in November, bringing YTD results down to -3.64%.

Dispersion in this space remains very large with the best performing fund returning 35% this year and the worst performer down -28%. A bit less than 20% of funds in our index universe are able to still show positive YTD results.

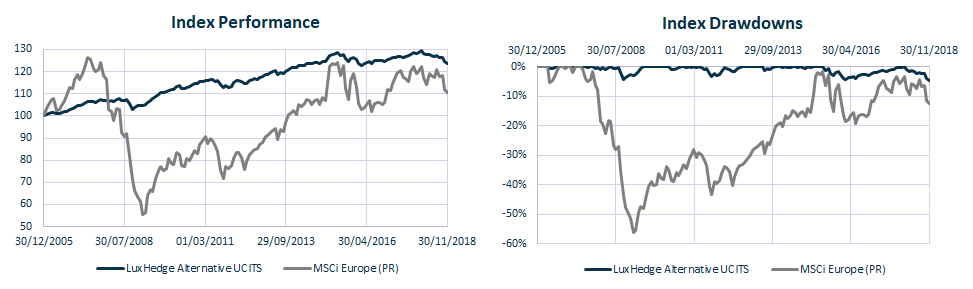

The 2 charts below put things in a broader historical perspective, illustrating that Alternative UCITS generally follow market downtrends somewhat due to their low but positive beta, but drawdowns are generally much more contained and tend to recover quicker. Over the past 10 years, we have also seen the universe shift from mainly Fixed income Alternatives towards more Equity Hedge and Multi Asset Alternatives which has increased the overall equity market sensitivity to some extent.

Assets under Management in the overall universe declined with -2.5% since last month. Especially Equity Hedge strategies suffered from outflows with both Equity Long/Short and Equity Market Neutral funds seeing their assets under management decrease with respectively -4.1% and -5.5% during the month of November. Within Fixed Income Alternatives, allocations were mainly reduced on Absolute Return Bonds (AUM -3.3%) and Credit Long/Short funds (AUM -3.8%). Discretionary Macro managers still experience inflows with assets under management rising more than 3% last month. As we have noticed already a few times in the past, some investors try to time short vol funds when volatility picks up: assets under management for volatility trading UCITS increased with +1.2% in November. Even with the disappointing YTD results on Alternative Risk Premia UCITS, these funds continued to attract inflows of 1% last month.

Most Equity Hedge strategies declined in November with the LuxHedge Equity Long/Short UCITS index losing -0.53% and the LuxHedge Equity Market Neutral Index losing -1.25%. Overall, one out of four Market Neutral UCITS managers is able to generate positive results sofar in 2018. After a long string of losing months, managers focusing on AP had a very good month of November on average with the LuxHedge Equity Long/Short AP Index advancing +1.31%.

Within the macro space, Discretionary Macro managers performed relatively flat in November: LuxHedge Discretionary Macro UCITS Index +0.14%. CTA & Managed Futures UCITS keep having a very difficult 2018 with the index declining -1.12% in October, bringing YTD down to -7.73%.

Alternative Risk Premia UCITS are increasingly popular with investors, but have on average not been able to provide positive results this year. The Alternative Risk Premia UCITS Index declined with -0.61% in November, only one 1 of the 36 index constituents posted a positive result sofar in 2018. Also Fund of Funds are having a tough year on average with the index down -4.11% and only 2 out of the 73 index constituents in positive territory year-to-date.

For further details, please refer to monthly LuxHedge Market overviews