11 Oct 2018 Flat performance for Alternative UCITS funds in September

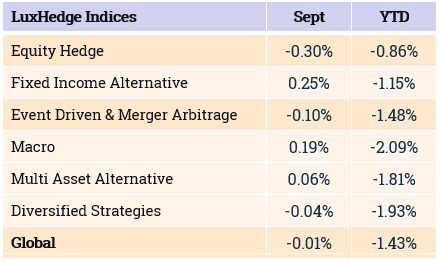

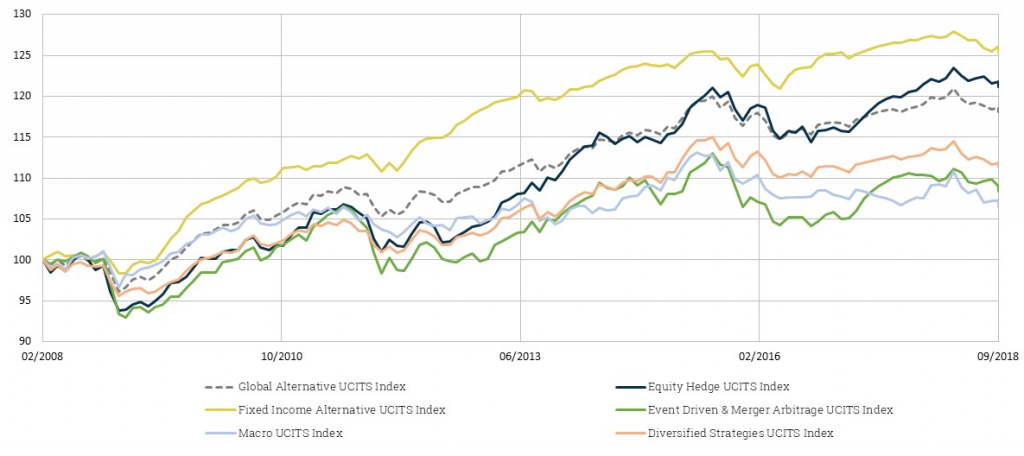

Many Alternative UCITS funds continue to have a difficult time delivering in 2018. The LuxHedge Global Alternative UCITS Index posted a small loss of -0.01%, bringing 2018 YTD to -1.43%. Half of the nearly 1000 index constituents posted positive results in September. Fund picking remains of utmost importance in this universe as illustrated by the large spread between the best performer in September (+17.4% Global Macro fund) versus the worst (-6.7% Equity Long/Short Emerging Markets fund).

After a 5% increase in assets under management between January and August, investors allocated slightly less to Alternative UCITS in September with net outflows of -0.8% for the month.

On average, Fixed Income alternative managers were able to post positive results in September. The LuxHedge Rates Long/Short Index advanced with +0.6%, Credit Long/Short funds posted a +0.2% gain. After a difficult start of the year, Absolute Return Bond funds regained +0.2% in September bringing YTD for the index to -1.4%.

Most Equity Hedge UCITS had a more difficult month of September with both the LuxHedge Equity Long/Short and Equity Market Neutral indices declining -0.3%. Losses for managers focusing on Europe and US were relatively contained. In line with previous months, managers focussing on AP and Emerging Markets had a considerably more difficult time finding opportunities: LuxHedge Long/Short AP Index -1.3% (YTD -6.4%).

September was a month with large gains for Discretionary Macro managers, emphasized by spectacular double digit gains in a few Global Macro and Macro Bond funds. The LuxHedge Discretionary Macro Index advanced by +1.7% during September. Systematic CTA strategies continued their 2018 downwards path with the LuxHedge CTA UCITS Index posting a loss of -1.1% in September (-4.4% YTD). Declines were broadly spread across the CTA UCITS space with only 1 out of 4 funds in positive territory for both Trend Following and Diversified Quant CTA strategies.

Alternative Risk Premia UCITS strategies are increasingly popular with investors, growing very fast in size with a +9% increase in assets under management for the month of September. Total assets in Alternative Risk Premia UCITS have now reached 18BEUR. Also Discretionary Macro strategies continue to attract new inflows with assets rising by +3% in September. The negative YTD performance for many Absolute Return Bond UCITS funds translated into large September asset outflows of -4.7%.

For further details, please refer to monthly LuxHedge Market overviews