11 Jul 2018 Wolfgang Bauer, Fund Manager, M&G Absolute Return Bond Fund

Dr Wolfgang Bauer is the Fund Manager of M&G’s Absolute Return Bond fund. Wolfgang gained a PhD in chemistry from the University of Cambridge, holds the Investment Management Certificate (IMC) and is a CFA and CAIA charterholder.

LuxHedge – Can you please start by explaining your investment philosophy? Do you have any guiding principles?

M&G – In my view, it ultimately comes down to how high we assess certain risks and how much we are getting in return for taking these risks. Obviously there are a lot of unknows because we can only make educated guesses on the probability of certain risks materializing. Stripped of all complexity, this is the essence of prudent investing: estimated risk versus estimated return.

In the example of interest rates, we would ask ourselves many questions: what is our anticipation of rate hikes? Where are current prices? How much buffer do current valuations give to absorb further price increases? What about credit risk as a factor? Then it comes down to how these risk factors impact one another and how they stack up. After careful consideration, we would select specific risk factors that we want to be exposed to.

LuxHedge – Can you give an example of how you take specific risks ?

M&G – Assume that we want to take exposure to credit spreads at the long end of a US Telecom company in dollars, but we are not really keen on taking interest rate risk and also don’t want to take currency risk either. In this case, we would buy the long-dated dollar denominated cash bond and partially or fully hedge out the interest rate and currency risk. In this way, we just leave the credit risk factor in the portfolio, exactly the exposure we wanted. The fixed income markets allow you to have these degrees of freedom which is a great way of expressing your convictions.

LuxHedge – You mean there’s a sufficiently developed derivatives market that allows you to be selective ?

Yes exactly. The fixed income derivatives market allows you to disentangle the main factors like interest rates risk and currency risk at a very reasonable cost. The corporate credit side is a bit more complicated: the market for single name CDS’s is less liquid because it has become very costly for banks to be involved as counterparties.

LuxHedge – Can you introduce us to the team that manages the Absolute Return Bond fund on a day-to-day basis?

M&G – The team has been expanding significantly over the years. On fund management side, we are currently with 12 fixed income fund managers, Jim and I taking the lead for the Absolute Return Bond fund. Between us 12, we cover all the corners of the public bond market on macro side, Emerging Markets, Investment Grade, High Yield, etc… We truly believe in idea sharing and collaborating and have a system of being co-manager of funds and deputy manager of others to encourage cross linking within the team. As an example, we’re currently quite active in the primary corporate bond market with new bond issuance almost every day. We don’t want to reinvent the wheel there: if someone in the team has done an extensive analysis to find out that a particular bond is very cheap, we would highly consider going for it with the Absolute Return Bond fund as well. We like to collaborate within the bigger M&G Fixed income team and leverage each other’s specific expertise.

Between Jim and I, I’m focusing on credit and he takes more of a macro angle. However, we always discuss the shape and the risk exposure of the overall portfolio together. Ultimately, we both have discretion: if we don’t like a certain trade then we don’t have to follow the advice of our experts. But in general, we trust on each other’s capacities.

Further, we are supported by a team of 40 credit analysts in London who cover everything from sovereigns to corporates, ABS’s and distressed securities. I would like to emphasize that our credit research team is not just a passthrough entity for people who want to become a fund manager later on. Our people are career analysts and have the ambition to become the best specialist in their domain. This is a very valuable resource for us because there is real value to be added by sound stock selection in credit markets. The market is much less commoditized compared to equities.

LuxHedge – Why is that? How would you compare credit selection to stock selection?

M&G – In credit, there’s more complexity and the opportunity set is much larger: bonds in different currencies, in different parts of the curve, different coupon prices, etc.. Understanding the details can result in an advantage for identifying opportunities.

LuxHedge – Can you give an example of how security selection added value?

M&G – GKN Group is UK-based manufacturing business with different business lines including delivering parts for automotive and aerospace. They were approached by a private equity consortium for a takeover bid which they rejected, giving rise to the usual back and forth. They have two very liquid sterling bonds outstanding. One of them has a change in control clause and other features while the other one is a bit less friendly to investors. The performance of these two is very different. Putting in the hard work and getting those fine details right can really make a difference.

LuxHedge – How is the Absolute Return Bond fund positioned? Where do you see value in today’s fixed income markets?

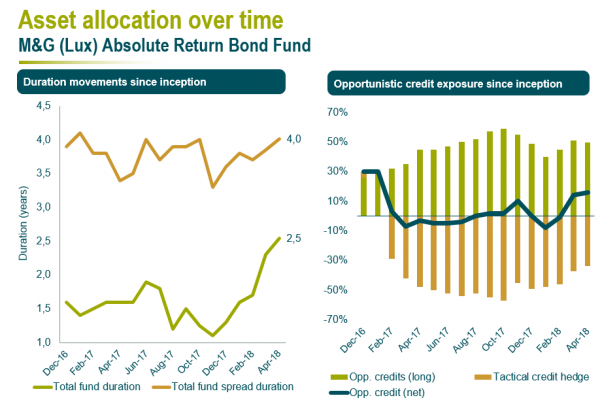

M&G – This is never black and white of course: you hardly find a part in the market where you think there is zero value or a part where there is incredibly good value. It’s always about the shades of grey in between. In general, the risk return profile of credit is still more convincing than of interest rates currently. But it’s very much a case by case or sector by sector story. Our relative preference of credit over interest rates on a risk adjusted basis has also narrowed recently. We added some interest rate risk in recent months after we saw major movements in rates and bond yields across the broad market.

In some sectors, taking more spread duration is still relatively attractive, for example telecom in dollar and sterling where the curve is still very steep. Other sectors like US senior bank debt have rather flat curves and we see no added value in going for longer maturities there.

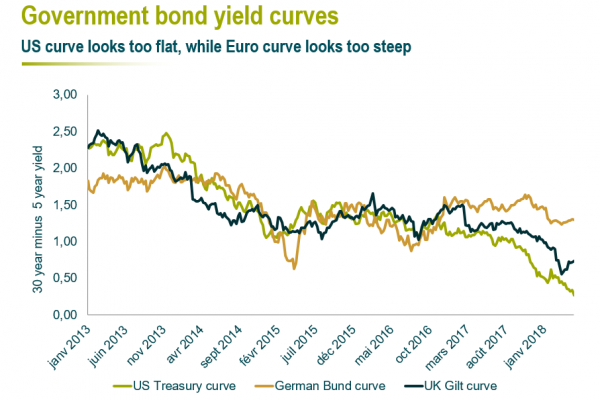

LuxHedge – How are you looking at rates today? What is your general view on the yield curve currently?

M&G – It depends a lot on the geography, we’ve seen a massive decoupling of different interest rates risks and monetary policies. In the US, we are convinced that the Fed is in hiking mode and will continue to increase rates at a moderate pace. The risk is that they have to do this a bit quicker than what the market expects or what they ideally would like to, because of inflationary pressures.

On the other hand, all central banks have an asymmetric risk profile. As a central banker, you prefer keeping the interest rate a bit too low for too long and have a slight overshoot of inflation in contrast to increasing rates too much and being blamed for the next recession.

LuxHedge – How does this view translate into the positions you hold in the fund?

M&G – In general, we are still relatively cautious when it comes to interest rate duration. During 2017 we were below two years interest rate duration, sometimes much closer to one year then to two years. We are still defensively positioned today, but we have taken the front duration above two years now. This reflects a certain repricing of yield curves and also acts as a shock absorber for some events that might negatively affect our credit positions.

Given the flat yield curve in US, we rather stay at the front-end. There has been a doubling of two-year treasury yields from 1,2% to 2,4%. We believe this is very meaningful and represents a proper repricing which we haven’t seen since 2008. We currently hold treasury bonds that mature in October 2019 and provide a 2,4% yield. Of course, we need to consider currency hedging costs as well, but on a pure standalone yield basis this is not bad at all.

LuxHedge – How do you look at the broad credit markets today?

M&G – Credit markets are very heterogeneous of course, but if we look at some really broad corporate aggregate indices, it is clear that credit spreads have come a long way. We are far away from the crisis levels or the levels we saw in the first quarter of 2016 with the oil price shock and the worries about the Chinese financial system. So credit has repriced and of course there are headwinds to come. The ECB is cutting back purchases of corporate bonds in Europe so the tailwind that supported valuations for a long time is slowly fading away.

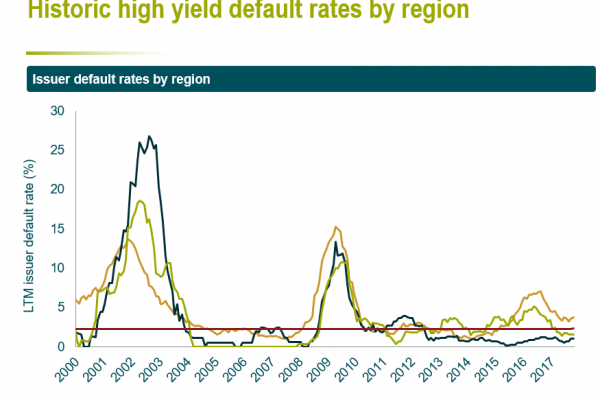

Taking everything into account, current valuation levels are still attractive in our view given low default rates and the compensation you receive for the actual risk of default. Current credit valuations generally compensate default risk, but the tight credit spreads are almost priced to perfection. So if you have headwinds ahead, there’s almost certainly going to be a weakness resulting in volatility.

Our general approach is having some exposure to credit but being very tactical in terms of how we position ourselves. In this light, we already mentioned primary bond markets where we do find value today.

LuxHedge – What is your view on High Yield currently?

M&G – In general, we are not overly keen on high yield as an asset class at the moment across our funds. High yield provides a higher credit spread compared to investment grade, as it should. But the incremental risk premium you currently get does not justify the incremental increase in default risk according to our view.

We are not completely shunning High Yield either. We do have some select exposure when the individual name justifies our view both from a credit risk and liquidity risk perspective.

LuxHedge – Do you hold any subordinated securities in the fund?

M&G – Yes certainly. We have dedicated analysts who are very experienced with hybrids and subordinated securities and who support us in selecting the right names and structures. These investments would typically be a buy-and-hold for us. For example, we still hold legacy tier 1 bank bonds where we see a lot of calls coming in the coming 2 years. We won’t trade these now at 30-50 basis points bid-offer spread, but are very comfortable in holding them until they will most likely get called this or next year.

LuxHedge – Would you buy these on the primary market?

M&G – No, we have bought them on secondary issue. If tier one’s would widen by 80 basis points, that would be a signal for us to buy some more. We have built up positions in a few select names like Santander and Lloyds where we know and have analysed the structure of the specific securities in every detail.

LuxHedge – Looking at the Absolute Return Bond fund, what would be a worst case scenario given your current positioning?

M&G – Assuming current fund positioning remains unchanged (as if we would not react to changing conditions), the biggest risk in the fund is currently credit risk, followed by interest rate risk and currency risk. The worst thing would potentially be an escalation of a trade war causing such a big impact that economic fundamentals would be massively impacted where growth would stop and we slide into a recession.

In such an environment, credit spreads would suffer quite considerably but our positioning on rates would potentially be a hedge due to safe heaven effects. This is also the main reason why we are not very long credit and outright negative on duration. We are deliberately aiming for a more defensive and balanced fund. It wouldn’t be in the spirit of the Absolute Return Bond fund to make it too one-directional.

LuxHedge – How are you currently positioned on currency side?

M&G – We would never be overly exposed to currencies because we manage volatility tightly and currencies are one of the most volatile assets you can find. At the same time, having a bit of active currency positions works as a diversifying element to our credit and rates exposure and offers us a nice flexibility. In our approach, we hedge out a lot of the currency risks to base currency euro and aim to not have more than 10% active currency risk in aggregate versus euro.

Those active positions are then split across a multitude of different currencies. On the developed market side where we aim to play defensively, we have some exposure to Japanese Yen, US dollar and Swiss Franc. On the more opportunistic emerging market side, it is even more important for us to split the risk in many small positions. Otherwise the fund would be very susceptible to certain idiosyncratic geographical risks which we absolutely want to avoid.

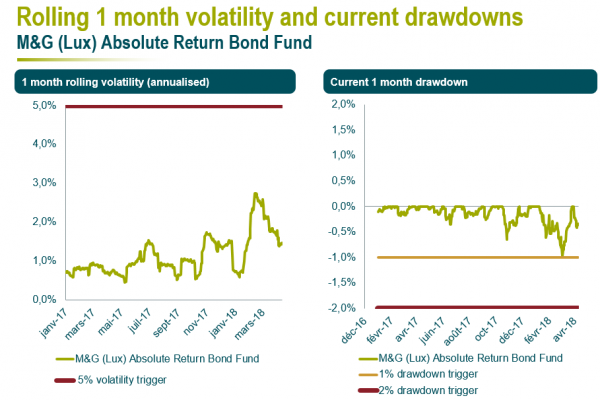

LuxHedge – On a fund level, what are your targets for return, volatility and drawdowns?

M&G – We have a clear return target of 2,5% above cash before fees over a 3-year rolling period, but we are not only looking at returns. On the volatility side, we have a 5% volatility trigger level, but we aim to manage the fund to stay between 1% and 3% for most of the time.

Risk management is probably the area where we spent most time when we were in the process of launching this fund. You could setup the fund in two very extreme ways. One the one hand, you could make it very deterministic: have automated stop-losses kicking in on an asset level, strategy level or fund level. This would be very helpful in managing volatility and drawdowns. The problem is that it would remove a lot of the fund’s discretion. We feel that’s an area where we can add some value, we don’t want to be forced to sell at the worst possible time. The other extreme would be to monitor risk: monitor drawdowns, monitor volatility, … knowing where we are but not being impacted. In my opinion, that is exactly how a lot of funds should be managed but this is not how we have set up the Absolute Return Bond fund because our investors expect a more defensive proposition.

Therefore, we have a two-staged process to stay prudent and manage drawdowns. At the 1% point, we would scrutinize the market environment and investigate if we need to make changes, but we are free to stay where we are. If we were to hit a 2% drawdown then we would not have to de-risk, there are no stop-losses, but we would not be able to add additional active risk positions and won’t add trades that increase value at risk. We have a similar process in place to manage volatility, but the drawdowns are the more restrictive condition.

LuxHedge – Can you talk us through a successful trade ?

M&G – A prime example would be Ryanair. If you look at the balance sheet or their cash flows, they are very solid. It’s firm investment grade and accordingly trading really tight for most of the time. But they had a rough time in October last year because of press releases on pilot strikes and later rumours that they might cancel flights close to Christmas. Subsequently, questions came up about the business model. We felt this was rather transitory, that those headwinds were not going to persist and that strong fundamentals would ultimately dominate. We went in at the beginning of October at 65bp and sold it 40bp tighter in January.

The nice thing about corporate bonds is that they mean revert as long as default is not happening. In other words, if your analysis shows that the company can stomach the headwinds, there are temporary dislocations that you can profit from.

LuxHedge – Thank you very much for the interview !

Disclaimer

LuxHedge SA/NV is a limited liability company governed by the laws of the grand duchy of Luxembourg. This report is for Institutional Investors only and is not suitable for Retail Investors. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but we make no representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of such information. In addition we have no obligation to update, modify or amend this document or to otherwise notify a recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate or other market or economic measure. Furthermore, past performance is not necessarily indicative of future results. The recommendations mentioned herein involve numerous risks including, among others, market, counterparty default and illiquidity risk. An investor could lose its entire investment. This communication is provided for information purposes only. In addition, any subsequent offering will be at your request and will be subject to negotiation between us. It is not intended that any public offer will be made by us at any time, in respect of any potential transaction discussed herein. Any transaction that may be related to the subject matter of this communication will be made pursuant to separate and distinct documentation and in such case the information contained herein will be superseded in its entirety by such documentation in final form. By retaining this document, recipients acknowledge that they have read, understood and accepted the terms of this notice. Each recipient of this document agrees that all of the information contained herein is confidential, that the recipient will treat information confidentially, and that the recipient will not directly or indirectly duplicate or disclose this information without the prior written consent of LuxHedge. Recipients who do not wish to undertake a further investigation of the contents of this presentation agree to return this document promptly to the LuxHedge. This notice shall be governed by and construed in accordance with Luxembourg Law. This document and the information contained therein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. Any direct or indirect distribution of this document into the United States, Canada or Japan, or to U.S. persons or U.S. residents, is prohibited.