18 Apr 2018 Alternative UCITS performance slides -0.69% in Q1 – Assets under Management increase with 2.5%

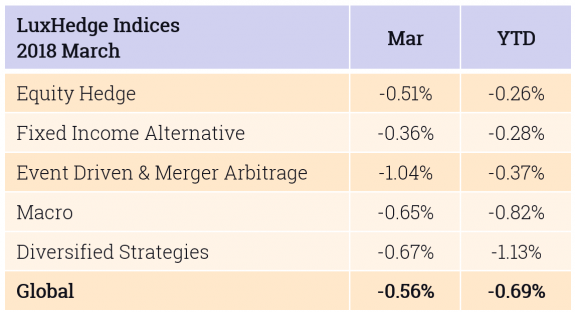

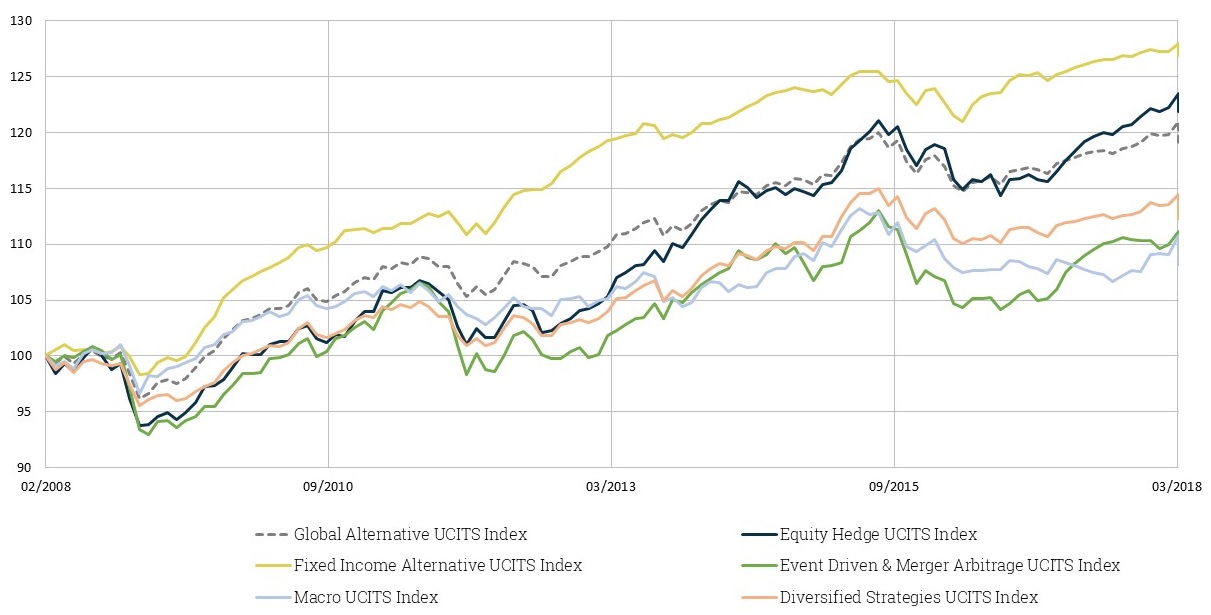

In line with the broader hedge fund market, the average Alternative UCITS fund showed a negative performance in Q1. The LuxHedge Global Alternative UCITS index declined with -0.56% in March, bringing 2018 YTD to -0.69%. Most Alternative UCITS funds went down because of a small long equity bias. To put things in perspective, the MSCI Europe Index stood at -4.17% YTD by the end of March.

In view of increased market volatility and declines in equities globally, portfolio allocations to Alternative UCITS funds grew considerably. Assets under Management for the total universe advanced with 12BEUR to 460BEUR (+2.5%). Investors mainly have an appetite for portfolio diversifying strategies such as Alternative Risk Premia (AUM +12%), Multi Asset Absolute Return (AUM +14%) and Discretionary Macro funds (AUM +12%). The relatively small segment of Long/Short Thematic funds also keeps gaining in popularity with investors, growing from 2.1BEUR to 2.4BEUR during 2018 Q1 (AUM +10%).

Performance for Alternative UCITS funds was negative across almost all strategies with only 10% of funds in positive territory for 2018 YTD.

Within Equity Hedge strategies, Equity Long/Short funds did not overcome the negative effect of their long equity bias in 2018 Q1: LuxHedge Equity Long/Short Index -0.61% YTD. Equity Market Neutral Funds avoided the drawdown in equities and are flat for the year on average: +0.01% YTD. This space is very diverse though with the best Market Neutral fund returning well over 6% YTD.

After a strong start in January, Event Driven and Merger Arbitrage funds are also in slightly negative territory: LuxHedge Event Driven & Merger Arbitrage UCITS Index: -0.37% YTD.

Performance of Discretionary Macro funds was very mixed in 2018 Q1 with YTD performance varying between -4% and +4% for the 46 constituents of the index. On average, performance was flat: LuxHedge Discretionary Macro UCITS Index -0.12% YTD. After a very solid month of January, performance of CTA funds declined in February and March, across Trend followers, Short term traders and CTA Diversified Quant strategies: LuxHedge CTA & Managed Futures UCITS Index -2.69% YTD.

Alternative Risk Premia UCITS were the only strategy to show a slightly positive performance in March: LuxHedge Alternative Risk Premia UCITS Index +0.19% (YTD -1.29%).