30 Nov 2017 Vincent Weber, Portfolio Manager & Head of Research, Prime Capital

LH: Can you briefly introduce Prime Capital to us?

Vincent Weber: Our company was founded in 2006 as a specialist manager that focusses on Alternative investments. We cover the whole liquidity spectrum: liquid investments like our Target Beta fund, hedge funds with monthly or quarterly liquidity, private debt, infrastructure and private equity. These different businesses are managed by different investment teams that focus on their area of expertise. All these make use of the common compliance and IT resources of Prime Capital. Our firm has grown a lot over the past 10 years and we currently manage 10BEUR in assets. We are proud that we are still a fully independent firm, owned by management and employees.

LH: How would you describe the philosophy of Prime Capital?

Vincent Weber: The company started as a hedge fund manager with a clear focus on unconstrained alternative investing and this is still very much a part of our DNA today. We take an entrepreneurial approach in growing the company and we like to disrupt new markets and capture certain specialist niche segments.

In our investments, we are very centred around data and research. Everything at Prime Capital is done in a systematic and process-driven way, with a strong emphasis on data analysis. This is of course very logical when running systematic hedge fund strategies like Target Beta, but the exact same approach also underlies our other business lines.

LH: With such a focus on data and analysis, what type of people work in your research teams?

Vincent Weber: We have a wide mix of profiles coming from economic, econometric, statistics and computer science backgrounds. Every research team member needs to have a good technical grounding in data analysis and software coding. There’s a lot of fuzz currently on how big data is revolutionizing businesses and industries. To us, this is no real news. It is something that we have been embracing since the launch of our company: big data is taken into account in all of our investment processes.

LH: Speaking of buzz, do you have any view on Artificial Intelligence and machine learning trading models?

Vincent Weber: We are running such models already since the start, but we explicitly don’t like to use the word artificial intelligence. We prefer to speak of statistical analysis or perhaps ‘statistical learning’, avoiding the hype and giving a clearer view on what the models actually are.

LH: Can you give us an insight on your client base? Which investors are especially attracted to the investment solutions of Prime Capital?

Vincent Weber: We serve European Institutional clients. Germany and Austria are our biggest markets, but we also have clients in Luxemburg, France, Belgium and The Netherlands. We are very diversified in terms of client types, with large family offices and pension funds making up most of the client base in Germany.

LH: Moving into the Target Beta fund, can you give us some background on how you started trading the strategy?

Vincent Weber: Somewhere early 2014, we were approached by one of our clients, an insurance company, that was specifically looking for a quantitative strategy to harvests risk premia. We analysed the market and identified some common problems with the existing solutions. There was a lack of robustness: many strategies were overfitting the data giving rise to great backtest, but disappointing live performance. Next to that, we also identified a lack of cost focus when running such funds. Few funds were closely monitoring their operating expenses, transaction costs, ensuring efficient cash management, etc. We felt that we could make a difference on both aspects and set ourselves the target of doing better. The Target Beta UCITS fund launched in 2015.

LH: Which research and which convictions are at the basis of the Target Beta fund?

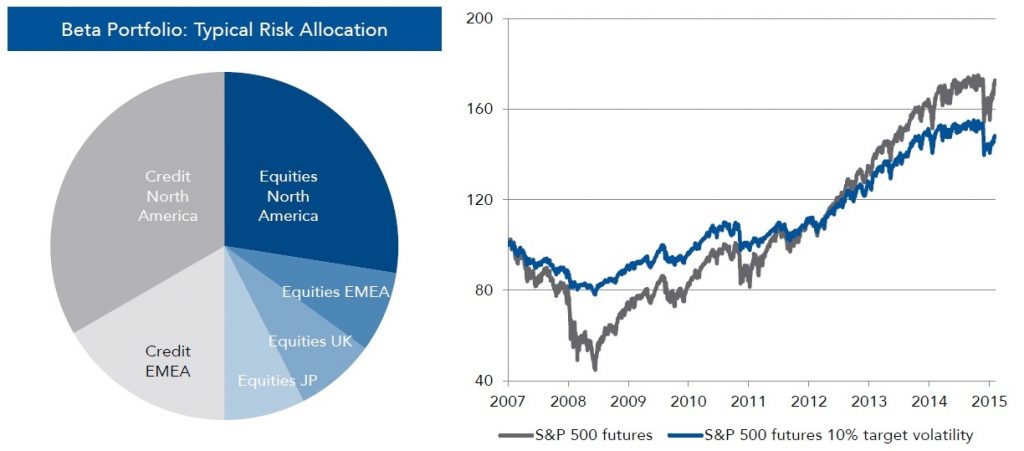

Vincent Weber: Our research has clearly shown us 2 things. First, there is long term value in being exposed to risky assets like equity and credit. This is how you make money in a classical allocation: buy stocks and bonds. This comes with large fluctuations though, something that can be improved by focussing more on risk. Secondly, we believe in our ability to time markets and generate superior risk adjusted returns based on a careful research on past market behaviour. Target Beta combines these 2 convictions in one strategy.

LH: Adding these 2 strategies together, what is the resulting market beta and correlation structure of the fund ?

Vincent Weber: The total portfolio will show a modest beta to equities over the long term while being able to correlate very weakly during short periods of increasing risk aversion. Our typical beta would be 0.2, with the long book contributing 0.4 and a beta neutral tactical book. Even with the long positions, our typical market correlation is around 0.5, comparable to many long/short equity strategies.

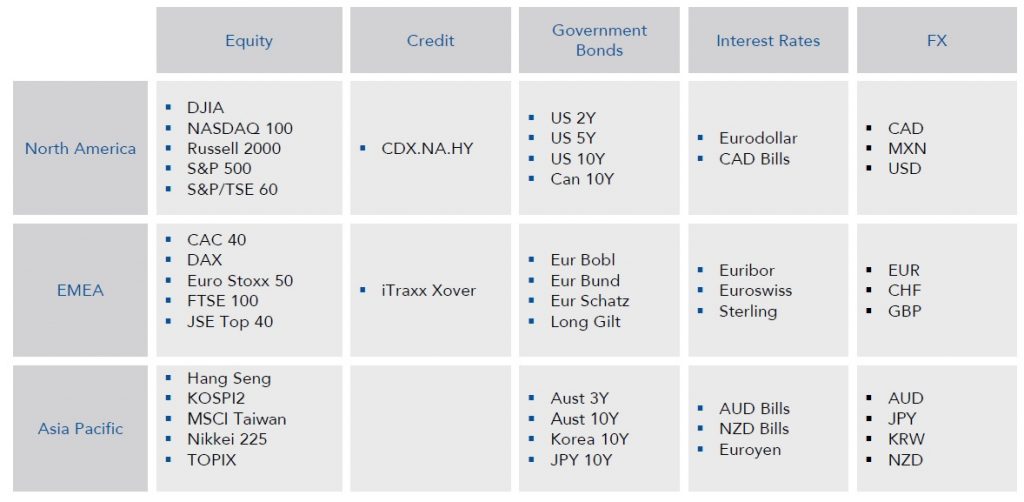

LH: Can you reveal which securities you trade in Target Beta?

Vincent Weber: Yes of course, as part of our philosophy we aim to be as transparent as possible. We trade only highly liquid derivative instruments with limited counterparty risk like equity and credit indices, government bonds, rates and foreign exchange pairs. Our Target Beta portfolio consist of a “cash book” with high quality short term paper and a small margin account to fund our listed derivative positions.

LH: Diving into the 1st part of the strategy how do you manage the long book?

Vincent Weber: As indicated, we want to capture the long term value of equities and credit while smoothing out large movements both on up and down side. To achieve that, we focus on risk management by very regularly adjusting our position size based on several conservative risk metrics. During stressed market conditions, our positions tend to be very reduced. In the long book, we don’t take a particular view on one market against another, as we entirely focus on risk control. The risk budget is 50/50 divided between equities and credit.

LH: With an exposure to credit, how do you expect this part of the portfolio to behave when interest rates rise?

Vincent Weber: We want to be exposed to credit spreads, not to interest rates risk. Our long positions in corporate credit are taken through credit default swap (CDS) indices which are duration neutral.

LH: Can we move into the 2nd part of the strategy? How do you run the tactical long/short book?

Vincent Weber: This component runs similar to many CTA style strategies that take long/short positions in different asset classes: equities, currencies and bonds. This 2nd component also runs fully systematic, using several market momentum and fundamental indicators. The edge of our strategy is not so much in the structure of each indicator, but in the combination of all strategies being active at the same time. We believe in diversification of risk and adjust our positions based on many indicators that are all active at the same time. This means that at any point in time, we are invested in all markets and all indicators. Every day, we will make a small marginal adjustment to our positions.

LH: Can you explain how this dynamic position sizing works?

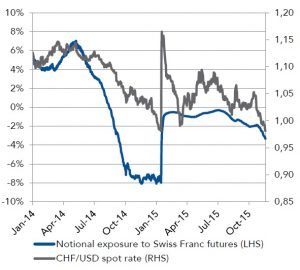

Vincent Weber: To illustrate, we can take an example like the CHFUSD currency pair (note: see graph below). This charts illustrates 3 key points: Firstly, our positions are not binary invested, like yes/no. We are always invested in the market and continuously adjust our exposure. Secondly, there’s a trend following component: while the market is dropping, we are increasing our short position. Lastly, we apply a very tight system of risk control. When an extreme event happens like the decoupling of the Swiss franc in Jan 2015, we are automatically reducing exposure and almost completely exit the market. Following the event, we very carefully start to re-build our positions again. We believe that this dynamic is not very different from how discretionary allocators would behave, but our value comes from doing this is in a systematic and methodological way across a large number of instruments.

LH: Do you automatically execute orders to adjust positions?

Vincent Weber: On the execution side, Target Beta is of course a global product that trades around the clock. Each instrument is rebalanced at least once per day, trading Asia in the morning, US and Europe in the afternoon. But the order execution is deliberately not implemented automatically. It is systematic and process driven like everything that we do, but it’s not fully automated. The entire process takes about 5 minutes to get trades done and there is still a trader involved to perform sanity checks and get the orders executed.

LH: Alternative funds are designed to absorb shocks during bad times. How do you expect this strategy to behave in case of another stress event?

Vincent Weber: Our prediction models are very slow with a typical time frame of several months. However, and I believe that this is really differentiating us from our peers, our risk management is extremely dynamic and conservative. When risk aversions increase, we will very quickly adapt and shrink exposure within a few trading days, as the example of the Swiss franc illustrated.

It is difficult to judge however how exactly a fund will behave under future stress conditions, as markets never really behave exactly the same. We tested the strategy against 25 years of data which we believe provides as much confidence as one can get. To give some concrete examples, during the last equity sell-off in Q1 2016, we performed positively (+3%). Also during the Brexit period, we were truly decorrelated and June 2016 performance came in at +2.50%. During the most extreme conditions in 2008, the strategy would have lost -4.6% with the market being down a large multiple of that amount.

LH: Next to your very dynamic risk control, where else is this fund taking a differentiating approach?

Vincent Weber: At the basis, we use solid building blocks like methodical research, a robust trend following model, conservative risk measurement and a keen eye for detail on trading execution. But I believe our biggest differentiator is that we truly are a “no surprise” product. We aim to consistently rank amongst the first tier funds in the systematic macro space, and are able to achieve that goal so far. Rather than occasionally hitting the highest returns, return consistency is what we are really looking for and also what our investors appreciate in the fund.

LH: How do your client investors use the Target Beta fund?

Vincent Weber: The fund is most often used as a diversifier for a traditional equity/bond portfolio, generating returns while absorbing shocks during periods of market stress. Next to this, we notice that many clients who manage diversified portfolios also invest in liquid alternatives as a substitute to their fixed income allocations. Even if there is an equity component to our strategy, this fund has more in common with fixed income investments if you look at it from a risk point of view. On top of that, the fund has a very low duration which is exactly what investors are looking for right now. All of this makes it an excellent candidate to replace a bond allocation, which is also how many of our clients currently use the strategy.

LH: Do you have any view on future Alternative products from Prime Capital? Any future launches that you are currently working on?

Vincent Weber: We are continuously looking to serve our client base and innovate with new solutions where we can add value. Since a long time, we have been engaged in some very interesting research on how to select single stocks. We might take that further in the future and offer this knowledge to investors as an unconstrained long/short equity strategy.

LH: To conclude, we have seen some recent launches of Alternative, hedge fund style strategies in ETF format. Both long/short equities and trend following systematic strategies are being launched. What do you think about that evolution?

Vincent Weber: We are aware of this evolution and are monitoring this market. From an opportunistic point of view, as a manager, this could be an easy way to tap into a growing European ETF market. But I’m not convinced that this is a necessarily also beneficial to investors. ETFs have an inherent complexity and it’s not clear to me how the ETF wrapper can help to bring alternative strategies at a lower cost, which is clearly what investors would expect. For systematic strategies, I also believe that there’s simply no added value of being able to trade in and out intraday. Assuming a similar cost structure for the fund – which is already a stretched assumption – I would prefer to buy daily at NAV, rather than buying intraday and giving away the bid-ask spread to a market maker.

LH: Thank you very much, Vincent, for the interview !

Disclaimer

LuxHedge SA/NV is a limited liability company governed by the laws of the grand duchy of Luxembourg. This report is for Institutional Investors only and is not suitable for Retail Investors. The information herein is believed to be reliable and has been obtained from sources believed to be reliable, but we make no representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of such information. In addition we have no obligation to update, modify or amend this document or to otherwise notify a recipient in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. Analyses and opinions contained herein may be based on assumptions that if altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency rate or other market or economic measure. Furthermore, past performance is not necessarily indicative of future results. The recommendations mentioned herein involve numerous risks including, among others, market, counterparty default and illiquidity risk. An investor could lose its entire investment. This communication is provided for information purposes only. In addition, any subsequent offering will be at your request and will be subject to negotiation between us. It is not intended that any public offer will be made by us at any time, in respect of any potential transaction discussed herein. Any transaction that may be related to the subject matter of this communication will be made pursuant to separate and distinct documentation and in such case the information contained herein will be superseded in its entirety by such documentation in final form. By retaining this document, recipients acknowledge that they have read, understood and accepted the terms of this notice. Each recipient of this document agrees that all of the information contained herein is confidential, that the recipient will treat information confidentially, and that the recipient will not directly or indirectly duplicate or disclose this information without the prior written consent of LuxHedge. Recipients who do not wish to undertake a further investigation of the contents of this presentation agree to return this document promptly to the LuxHedge. This notice shall be governed by and construed in accordance with Luxembourg Law. This document and the information contained therein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. Any direct or indirect distribution of this document into the United States, Canada or Japan, or to U.S. persons or U.S. residents, is prohibited.